Good deals are an essential part of being a college student these days. Many students find themselves having to get creative when it comes to finding good meals with even better prices. Jason Remy ’23, is a student at Loyola University Maryland who has developed a list of spots in the Baltimore area that have great meals at affordable prices. For example, he is a frequent goer of BJ’s Brewhouse.

“As an avid weightlifter and student on a budget, I like to go to BJ’s Brewhouse,” Remy said. “They’ve got some of the best wings and nachos ever.” BJ’s Brewhouse is located in Towson and has a wide selection of American cuisine and alcoholic beverages.

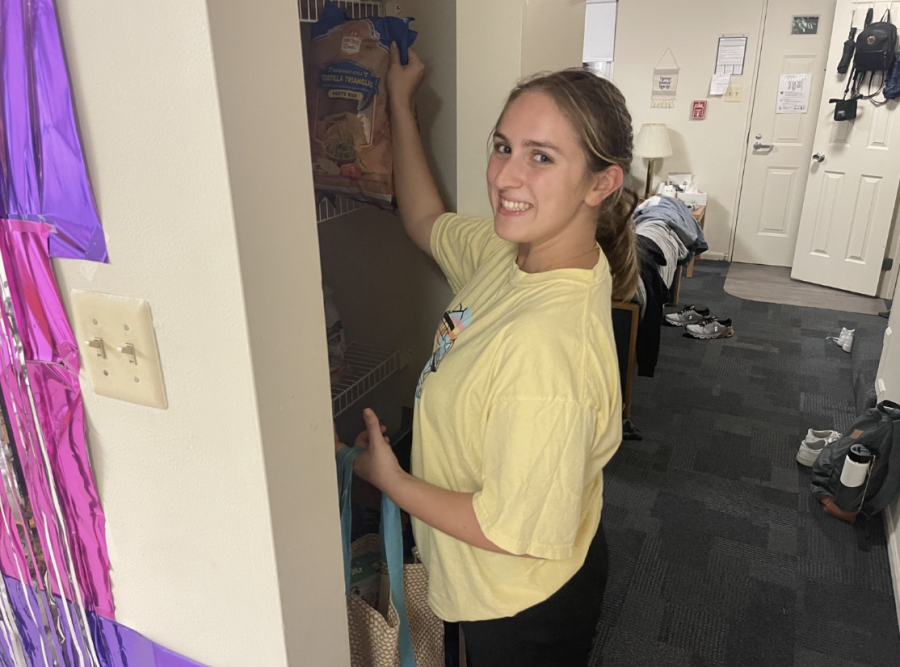

For those on a tighter budget, eating at home is the best way to save money. These days, weekly groceries can range from $80-$100 for a college student. Students say grocery stores such as Walmart and Aldi’s are more affordable, compared to places like Whole Foods and Mom’s. Becca Grunski ‘23, is on a strict budget when she buys food.

“I feel like the key to weekly grocery shopping is picking items that are easily versatile with different meals,” Grunski said. For many students, pre-making meals is the perfect way to save money and time during the week. Grunski, like many of her college-aged peers, prefers to make her meals at home as opposed to using food delivery services.

“When you use Uber Eats or DoorDash, you are spending almost as much on fees, taxes, and tips as you’re spending on the meal,” she said. “Suddenly a $10 meal is now a $20 meal. It’s like, what’s the point now?” By shopping at grocery stores like Aldi’s and limiting the amount spent on nights out, students can spend their money on things they really want.

“I am a typical broke college student and I’d rather spend my money on other things,” Grunski said, “If I’m going to spend my money on another item, it would be something that I wear or an experience.” Remy and Grunski are prime examples of students who are focusing on their finances in preparation for post-graduation life. It can be easy to spend a lot of money on meals while out with friends but both students actively engage in budgeting techniques that allow them to add money to their savings and prepare for their future.

Featured image courtesy of Genevieve Green