One of the hardest parts about living on your own in college tends to be managing your money, but knowing how to manage your own finances is a crucial step toward gaining independence as a young adult.

A good place to start when it comes to managing your money is by creating a budget. Every college student should have some form of a budget. Whether it is self-made or created by your parents, a budget is key to controlling how and when you are spending your money.

Personally, I have developed a monthly spending budget because that tends to be what works best for my spending habits. If you find yourself struggling to stick to a monthly budget, a weekly, or even bi-weekly budget might work better for you. It might even be beneficial for some to center their budget around their work pay periods.

Now, the first step to creating a budget is determining where you are spending your money. For most college students, money typically goes towards four or five major categories: food, transportation, shopping, social events, and in some cases, bills.

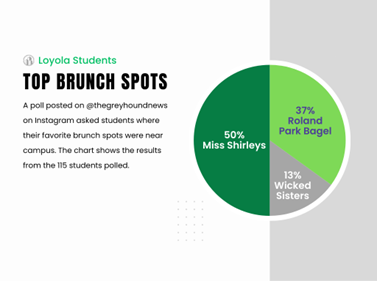

While nearly all students are required to have a meal plan, it is not uncommon for students to want to eat off campus or order in every once in a while. It is also important to account for all the money you spend on food at grocery stores. It may be even beneficial to track all the meal points you spend at Starbucks.

While nearly all students are required to have a meal plan, it is not uncommon for students to want to eat off campus or order in every once in a while. It is also important to account for all the money you spend on food at grocery stores. It may be even beneficial to track all the meal points you spend at Starbucks.

Transportation is what I find to be one of the biggest areas of spending for most college students, especially when living on a college campus in a city or far from your hometown. From Uber and Lyft, to bus, plane, or train tickets, money can disappear quickly.

In fact, even if you have your own car on campus you are still faced with expenses for parking, gas, insurance, and upkeep of the vehicle, so there is really no way of getting around having to pay for transportation, unless you consistently take public transportation everywhere, but that isn’t always a feasible idea.

Another big area where students tend to spend a lot of money is when it comes to social events. Whether it be a concert or show in the city, a festive Baltimore event, a day trip to Washington, D.C., or even just a night on the town with friends, expenses can rack up quickly.

Therefore, it is important to keep in mind how often you are taking part in these activities so you aren’t spending all your money on one trip or event. If you don’t keep this aspect of frequency in mind, you will either end up overspending or missing out on fun events because you can’t afford them.

Shopping is another area students typically need to budget. This category is meant to cover unnecessary shopping expenses such as clothes, gifts, accessories, etc. Pretty much anything that you don’t really need, but want anyway.

While it can be hard to stop yourself from buying that really cute sweater from Forever 21 or that brand new iPhone case, it’s important to spend shopping money in moderation so you don’t run out of funds for other more important thin gs.

gs.

Lastly, some students may have already had the responsibility of paying for certain bills. In this case it is really important that they are setting aside money to pay off those bills every month. Whether is a phone, insurance, or even tuition bill, it is imperative that this category take precedent over some of the other less necessary areas of spending.

Ultimately, depending on how much money you typically spend in each of these categories, you should be able to come up with an average amount you spend in total each week, month and year. From there, you can create your overall budget total.

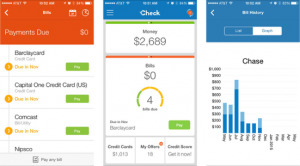

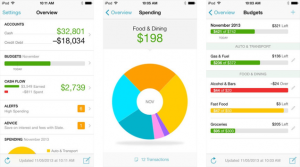

Once you’ve established what your spending money on and how much you’re spending, you can either choose to follow along with your budget on paper or online. I highly recommend using the Mint or Check apps because they create a really simple and efficient way for students to track their spending and adjust their budget as they see fit.

Featured Image courtesy of http://401kcalculator.org

Anonymous • Nov 2, 2017 at 6:34 pm

4.5