The Biden administration has announced its finalized regulations for the updated changes to student loan structure. These new changes will limit interest accrual and spread relief of loan forgiveness. According to NPR, the updated factors will have the opportunity to lower the debt of over 40 million people and completely relieve approximately the debt of 20 million students.

Loyola students will undoubtedly be affected by this relief plan and much like the nation at large, are divided about its efficacy.

Matt Butler ’23 said, “I’m not sure that it’s fair, many students take private loans that will not be forgiven. Also, the cutoff points seem to be completely arbitrary.”

However, another Loyola student extended their support.

Rebecca Stone ’23 said, “[Federal Student Loan Forgiveness] will help take pressure off of some financial stress since these loans are always collecting interest.”

The qualification process is quite simple. The U.S. Department of Education has set up a dedicated website for the purpose of applying for student loan relief. The only qualification is whether you have, as an individual, made less than $125,000 or less than $250,000 as a couple in 2020 or 2021.

The website only requires your full name, social security number, date of birth, as well as a current phone number and email address. There are no extraneous forms of accounts that must be created. There is also a box that must be checked that certifies that all the above information is true under the penalty of perjury.

After submitting your application, you should receive an email from the Department of Education confirming your submission. The process of approval is somewhat unclear. The only information that has been released thus far is that the Department of Education will cross-reference your application against their loan and income information. If there are deviations from their records, you may be required to submit further documentation.

Currently, the Federal Student Loan Payment Pause is in place. This pause has currently suspended loan payments, guaranteed a 0% interest rate, and stopped collections on defaulted student loans. However, this system is set to end in the new year and students will once again be burdened by their loans.

U.S. Secretary of Education Miguel Cardona said in a press release regarding the newly expanded debt relief programs,

“These transformational changes will protect students who’ve been cheated by their colleges from the bureaucratic nightmares of the past and ensure that all our targeted debt relief programs live up to the promises made by Congress in the Higher Education Act. We’re also protecting borrowers from higher costs by limiting the practice of taking unpaid student loan interest onto their principal balances.”

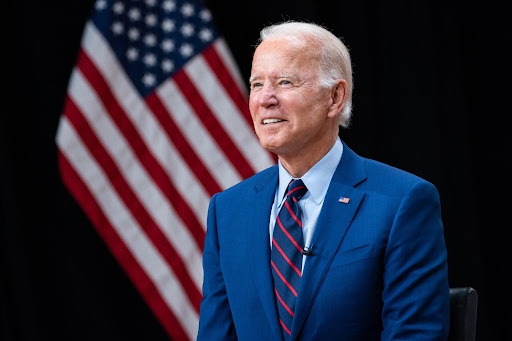

In a speech at Delaware State University, President Biden made clear that this student loan forgiveness will not eliminate all student debt.

“In relieving student debt, we’re also resuming student loan repayments that you’re going to have to start to pay… So, come January, folks whose debt isn’t fully canceled, you’re going to have to start paying the student loans off. That means billions of dollars a year are going to start coming back into the Treasury as well,” Biden said.

The president emphasized only lower-class and middle-class debtors will be relieved from their debt. He plans to collect the full amount for others who have received student loans but make more than the $125,000 or $250,000 cutoff point.

One of the most confusing aspects is whether students who have paid off the debt, but now qualify for debt relief will get their money back. The answer to this is complex. If your outstanding debt is less than the relief amount of either $10,000 or $20,000, the department will handle the entire process of returning that money. It will be automatically redeposited back into your account. If not, the status of your money will be included toward your debt.

Featured Image courtesy of The White House via Wikimedia Commons.